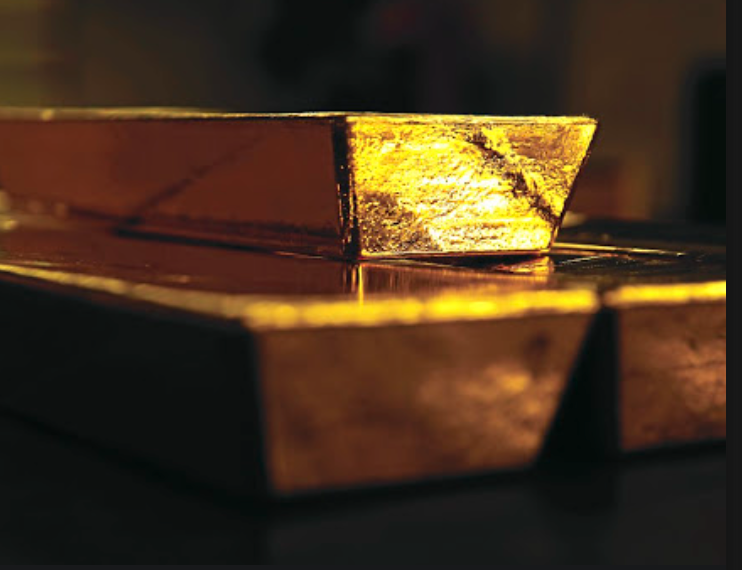

Gold prices, as of May 28, 2025, at 01:48 AM PDT, are currently trading at approximately $3,307.60 per ounce, according to recent market data from TradingEconomics. This price reflects a slight daily decrease of -1.44 (-0.04%), following earlier fluctuations where prices reached $3,311.47 earlier in the day, as reported by Yahoo Finance. This movement aligns with the headline observation that gold has increased after a recent loss, influenced by a combination of US economic data and ongoing trade discussions, particularly between the US and the EU.

The gold market has shown resilience, holding above the $3,300 threshold despite pressures from a strengthening US dollar and easing trade tensions. Based on over-the-counter (OTC) and contract for difference (CFD) instruments, the price is intended as a reference for market participants, with historical data from 1968 to 2025 showing significant volatility. The daily change of -0.04% contrasts with a yearly increase of 41.45% since the beginning of 2025, indicating a robust annual performance despite short-term fluctuations.

Influence of US Economic Data

A key driver behind recent gold price movements is May’s US consumer confidence report, which rebounded sharply from near a five-year low, signaling improved economic and labor market outlooks. This positive data has led to a stronger dollar, as noted in market analyses, which typically makes gold more expensive for buyers using other currencies, potentially exerting downward pressure on prices. The dollar’s strength was further influenced by external factors, such as Japan’s potential adjustments to debt issuance, affecting global bonds and the US currency, as mentioned in a Bloomberg article from May 27, 2025. Investors are also gearing up for the Federal Reserve’s preferred inflation measure, the US personal consumption expenditures price index excluding food and energy, due on Friday, May 30, 2025, which could provide further clarity on economic trends and impact gold prices.

Role of US-EU Trade Talks

Trade negotiations between the US and EU have been a significant focus, with recent developments suggesting progress that may influence gold’s safe-haven appeal. Reports indicate that President Donald Trump has expressed optimism about the talks, and the EU has expedited negotiations to avoid tariffs, previously threatened at 50% levies. As highlighted in a Reuters article from May 28, 2025, this easing of tensions has capped gold gains, reducing demand for the metal as a safe-haven asset. Additional news from Euronews and The Guardian on May 28 and May 27 underscores Germany’s DAX hitting a record high amid easing tensions and Trump’s indication of positive progress, respectively. These developments suggest that improving trade relations could continue to weigh on gold prices, as investors perceive less need for protective assets.

Additional Supporting Factors

Despite the pressures from economic data and trade talks, gold has maintained a price above $3,300, suggesting other supporting factors are at play. Historical data and forecasts indicate growth potential, with CoinPriceForecast predicting prices could reach $3,858 by the end of 2025, a 17% increase from current levels. This resilience may be attributed to global uncertainties, such as geopolitical risks, particularly in regions like Ukraine, as mentioned in an Economic Times article from May 27, 2025, and strong demand from China. Central bank buying and inflation expectations, as noted in long-term forecasts from LiteFinance, could also support prices, with predictions of reaching new highs of $5,917.17–$5,952.00 if economic conditions remain challenging.

Market Sentiment and Future Outlook

Market sentiment, as tracked by technical indicators, shows a neutral investor stance, with gold recording 13/30 green days and 1.52% price volatility over the last 30 days, according to CoinCodex. Short-term forecasts suggest prices could rise to $3,348 by early June 2025, reflecting potential for further movement. However, the interplay between a stronger dollar, easing trade tensions, and upcoming economic data releases will likely continue to shape gold’s trajectory. Investors are advised to monitor these developments closely, especially the PCE price index release, which could provide additional insights into inflation trends and Federal Reserve policy, potentially impacting gold demand. In conclusion, gold prices on May 28, 2025, reflect a complex balance of factors, with US economic data and US-EU trade talks playing pivotal roles. The metal’s resilience above $3,300 suggests underlying support from global uncertainties, but easing trade tensions and a stronger dollar pose challenges to further gains. Investors should remain vigilant to navigate this dynamic market landscape, particularly with upcoming economic releases.

+ There are no comments

Add yours