On June 5, 2025, the European Central Bank (ECB) reduced its deposit facility rate by 0.25 percentage points to 2%, marking its eighth consecutive rate cut since June 2024. This decision was driven by a decrease in eurozone inflation to 1.9%, slightly below the ECB’s 2% target, and aims to support economic growth amid global trade tensions, particularly due to U.S. tariffs .

ECB President Christine Lagarde emphasized a data-dependent approach for future policy decisions, indicating that while the current rate path is appropriate, the ECB is prepared to adjust its stance as necessary . The ECB also revised its inflation forecasts, projecting headline inflation to average 2.0% in 2025, 1.6% in 2026, and 2.0% in 2027 .

The rate cut has led to expectations of lower borrowing costs across the eurozone, potentially benefiting consumers and businesses. However, the ECB cautioned that escalating trade tensions could pose risks to economic growth, and it remains vigilant in monitoring global developments .

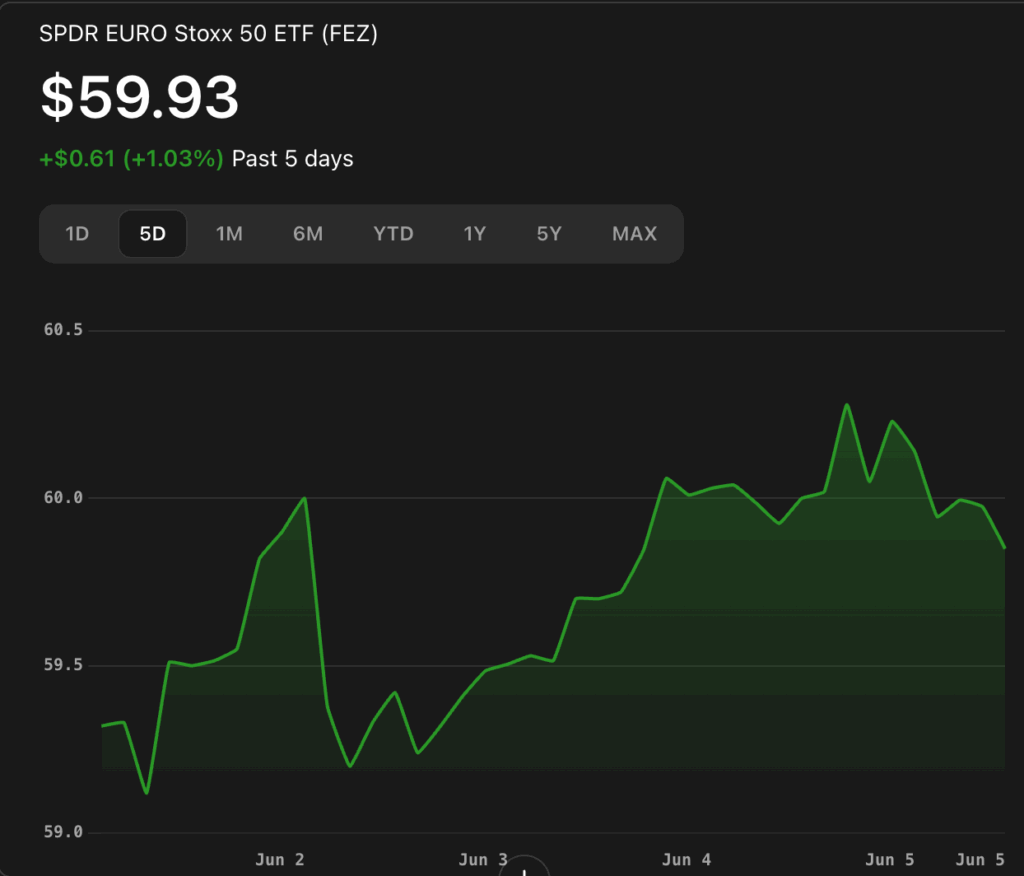

In financial markets, European equity ETFs have shown modest movements following the ECB’s decision:

These ETFs reflect investor sentiment towards European equities in the context of the ECB’s monetary policy and global economic conditions.

morningstar.com+1thetimes.co.uk+1theguardian.com

thetimes.co.uk+3reuters.com+3thesun.ie+3wsj.com+4ecb.europa.eu+4financialstandard.com.au+4

+ There are no comments

Add yours