Key Points

- It seems likely that oil prices have risen due to recent US strikes on Iran, with current prices around $75.18 for WTI and $78.32 for Brent crude.

- The Strait of Hormuz remains open, but there’s a significant risk it could close, given Iran’s parliamentary vote, though the final decision is pending.

- Research suggests potential economic impacts if the Strait closes, including higher oil prices and global market disruptions.

Current Oil Prices

As of 09:44 PM PDT on June 22, 2025, oil prices have increased following the US strikes on Iranian nuclear sites. The current price for WTI crude oil is approximately $75.18 per barrel, and for Brent crude oil, it’s around $78.32 per barrel, reflecting market concerns over supply disruptions.

Strait of Hormuz Status

The Strait of Hormuz, a critical chokepoint for global oil trade, is currently open. However, Iran’s parliament voted on June 22, 2025, to support closing it in response to the US actions, with the final decision still pending approval from higher authorities. This has led to increased caution among shipping companies, with vessels advised to avoid Iranian waters.

Survey Note: Oil Prices and Strait of Hormuz Status Following US Strikes on Iran

Following the US strikes on Iranian nuclear facilities on June 21, 2025, oil prices have seen a notable increase, driven by heightened geopolitical tensions and concerns over potential disruptions to oil supply, particularly through the Strait of Hormuz. This analysis, as of 09:44 PM PDT on Sunday, June 22, 2025, provides a detailed examination of current oil prices and the status of the Strait, based on available data and expert insights.

Oil Price Trends

Oil prices have risen in response to the escalating conflict. As of 12:34:52 AM EDT on June 23, 2025 (which aligns with 09:34:52 PM PDT on June 22, 2025), the West Texas Intermediate (WTI) crude oil price stands at approximately $75.18 per barrel, according to Yahoo Finance. For Brent crude oil, tradingeconomics.com reports a price of $78.32 USD/Bbl as of June 23, 2025, up 1.35% from the previous day, reflecting market adjustments to the increased risk premium.

Earlier reports indicate significant price movements, with oil prices jumping almost 3% on June 19, 2025, settling at $78.85 for Brent and $77.20 for WTI, and a 7% surge on June 13, 2025, following related tensions.

| Oil Type | Current Price (USD/Bbl) | Date and Time (EDT) | Source |

|---|---|---|---|

| WTI | 75.18 | 12:34:52 AM, June 23 | Yahoo Finance |

| Brent | 78.32 | June 23, 2025 (exact time not specified) | TradingEconomics |

The price increases are attributed to fears of supply disruptions, with experts warning of potential spikes above $100 per barrel if the Strait of Hormuz is closed, as mentioned in a CNBC article from June 15, 2025.

Strait of Hormuz: Current Status and Risks

The Strait of Hormuz, located between Oman and Iran, is a vital chokepoint, handling approximately 20% of global oil consumption, according to the US Energy Information Administration.

However, the situation is precarious.

On June 22, 2025, Iran’s parliament voted to support closing the Strait in retaliation for the US strikes, a decision that requires approval from the Supreme National Security Council and Ayatollah Ali Khamenei, as noted in a Wikipedia update and a Newsweek article.

Shipping advisories reflect the uncertainty, with the UK Maritime Trade Organization issuing cautions on June 11, 2025, and ships being advised to sail close to Oman to avoid Iranian waters, as per a Reuters article from June 18, 2025.

Historical context suggests Iran has been reluctant to close the Strait, even during past conflicts, as noted in a TWZ article from June 14, 2025, which states, “Iran has built unique capabilities to do exactly that, but has historically avoided full closure”.

However, the current situation, with US involvement and parliamentary support, adds complexity.

Economic and Global Implications

The potential closure of the Strait poses significant economic risks. If closed, oil prices could spike by 30-50%, potentially reaching above $100 per barrel, affecting global markets and inflation, especially in the US, as warned by JPMorgan Chase analysts in a Yahoo Finance report.

X posts from figures like Brian Krassenstein, with over 900,000 followers, predicted, “U.S. Gas Prices likely Skyrocket. Potential $5–$7/gallon range depending on duration. Military Escalation Risk,” reflecting public concern.

| Oil Transport Data (Q1 2025, EIA) | Volume |

|---|---|

| Crude Oil and Condensate | 15 million barrels/day |

| Petroleum Products | 8 million barrels/day |

| Total Daily Volume | ~20 million barrels/day |

| Global Consumption Share | ~20% |

| Destination (Approx.) | 80% to Asia, 2M b/d to US |

This table, sourced from the EIA, underscores the Strait’s critical role in global oil trade, highlighting the potential for widespread economic impacts if disrupted.

International Response and Expert Analysis

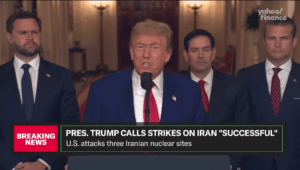

The US has taken a firm stance, with President Trump warning of further action if Iran retaliates, as stated on Truth Social on June 22, 2025.

Experts offer varied perspectives on the likelihood of closure. Javier Blas of Bloomberg, cited in Yahoo Finance, noted that Iran benefits from instability talk but closure would damage its economy, while Greg Kennedy of King’s College London emphasized the global strategic ripples, as reported in Newsweek .

Conclusion

As of June 22, 2025, oil prices are elevated at approximately $75.18 for WTI and $78.32 for Brent, reflecting market responses to the US strikes on Iran and the ongoing threat to the Strait of Hormuz. The Strait remains open, but with Iran’s parliamentary vote and international tensions, there is a significant risk of closure, which could lead to substantial global economic disruptions. The situation is highly volatile, with the interplay of US military posture, China’s economic interests, and Iran’s strategic calculations likely to shape outcomes in the coming days.

Key Citations

- Current WTI Oil Price

- Brent Crude Oil Price

- Crude Oil Price

- Oil to open higher as US strikes on Iran boost supply risk premium

- Strait of Hormuz Wikipedia page

- Iran’s Parliament Votes to Close Strait of Hormuz After US Attacks

- Ships advised to keep their distance from Iran around Hormuz Strait

- Middle East oil flows continue through Strait of Hormuz despite conflict

- Oil prices up nearly 3% as Israel-Iran conflict escalates

- Oil prices jump 7% and stocks drop as Israel-Iran tensions escalate

- Could Iran Carry Out Its Threat To Shut Down The Strait Of Hormuz

- Amid regional conflict, the Strait of Hormuz remains critical oil chokepoint

- What is the Strait of Hormuz, could it factor into Israel-Iran conflict

- Global oil prices soar after Israel attacks Iran

- Oil prices fall more than 1% on signs that Iran wants ceasefire with Israel

- How Could Strait of Hormuz Closure Impact Americans

+ There are no comments

Add yours