May 16, 2025

Berkshire Hathaway: Stabilizing Core Holdings, Adjusting Banks and Consumer Stocks

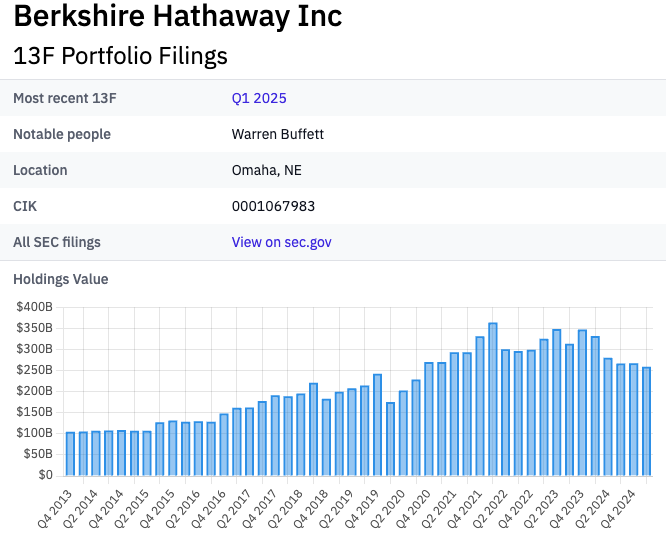

Portfolio Value: 259billion(down259billion(down8 billion QoQ). Top 10 holdings account for 89.02% of total value.

| Key Details | Information |

|---|---|

| Top Holdings | Apple (AAPL.US, 300M shares, $66.6B, 25% of portfolio), Amex (AXP.US), Coca-Cola (KO.US), Bank of America (BAC.US), Chevron (CVX.US). Buffett reaffirmed confidence in Apple at May 2 shareholder meeting. |

| Top Buys | Constellation Brands (STZ.US, +113% to 12M shares, $2.2B), Pool Corp (POOL.US, +140%), Domino’s Pizza (DPZ.US), Sirius XM (SIRI.US), Occidental Petroleum (OXY.US). Reflects focus on consumer/energy sectors. |

| Top Sells | Bank of America (-7%, sold 48.66M shares), Citigroup (C.US, fully exited), Nu Holdings (NU.US), Liberty Formula One (FWONK.US), DaVita (DVA.US). Signals caution on banking amid regulatory risks. |

Baillie Gifford: Shifting Focus to AI Software, Cutting Tech Giants

Portfolio Value: 115billion(down115billion(down15 billion QoQ). Top 10 holdings: 44.37% of total.

| Key Details | Information |

|---|---|

| Top Holdings | MercadoLibre (MELI.US), Amazon (AMZN.US), Spotify (SPOT.US), Shopify (SHOP.US), Sea Ltd (SE.US). All reduced by >10% in Q1. |

| Top Buys | Paycom Software (PAYC.US, +19x to 1.58M shares, 346M),SociedadQuıˊmicayMinera(SQM.US,+5x,346M),SociedadQuıˊmicayMinera(SQM.US,+5x,370M), Salesforce (CRM.US), AppLovin (APP.US). Bets on AI software and mining. |

| Top Sells | Tesla (TSLA.US), Spotify (SPOT.US), MercadoLibre (MELI.US), AMD (AMD.US), NVIDIA (NVDA.US) – each cut by >$1B. Reflects valuation concerns in tech. |

Bridgewater: Betting on Gold and Chinese Tech, Trimming U.S. Tech

Portfolio Value: $21.6 billion (slight QoQ dip). Top 10 holdings: 31.8% of total.

| Key Details | Information |

|---|---|

| Top Holdings | SPDR S&P 500 ETF (SPY.US, -60% stake, 8.67% weight), SPDR Gold Shares (GLD.US, +$319M), Alibaba (BABA.US), Microsoft (MSFT.US). |

| Top Buys | Alibaba (+710M),GLD(+710M),GLD(+319M), Baidu (BIDU.US, +$173M), PDD Holdings (PDD.US), JD.com (JD.US, new position). Bullish on gold and undervalued Chinese tech. |

| Top Sells | AppLovin (-110M),MetaPlatforms(META.US,−110M),MetaPlatforms(META.US,−110M), Alphabet (GOOGL.US), NVIDIA (NVDA.US). Cautious on U.S. tech valuations. |

ARK Invest: Doubling Down on Disruptive Tech, Exiting Legacy Names

Portfolio Value: 9.99billion(down9.99billion(down2.01 billion QoQ). Top 10 holdings: 48.49% of total.

| Key Details | Information |

|---|---|

| Top Holdings | Tesla (TSLA.US, $845M, -0.87% QoQ), Roku (ROKU.US), Palantir (PLTR.US), Roblox (RBLX.US), Coinbase (COIN.US). |

| Top Buys | Tempus AI (TEM.US, +35.9%, 95.6M),CRISPRTherapeutics(CRSP.US,+95.6M),CRISPRTherapeutics(CRSP.US,+40.6M), Deere & Co (DE.US), Iridium (IRDM.US), GitLab (GTLB.US). Focus on AI healthcare and gene editing. |

| Top Sells | Roku (-100M+),Palantir(−100M+),Palantir(−100M+), UiPath (PATH.US), Robinhood (HOOD.US), SoFi (SOFI.US). Exiting crowded tech names. |

Conclusion and Outlook

- Berkshire: Stability in core holdings (Apple, consumer/energy bets) signals long-term confidence. Banking cuts reflect sector risks.

- Baillie Gifford: Rotation from mega-cap tech to AI/software highlights growth focus amid volatility.

- Bridgewater: Gold and Chinese tech bets hedge macro risks; U.S. tech trimming aligns with valuation fears.

- ARK: Aggressive moves into AI healthcare (Tempus, CRISPR) and automation (Deere) underscore disruptive innovation bets.

Market Impact: Positive reactions to Tesla (+32% in Q2) and gold (GLD +19% in Q1) validate strategies. Long-term implications hinge on AI adoption, regulatory shifts, and macroeconomic trends.

+ There are no comments

Add yours