Federal Reserve Governor Adriana Kugler stated on Monday that the Trump administration’s tariff policies, despite recent progress in U.S.-China trade relations, could still push inflation higher and weigh on economic growth.

Speaking at an event, Kugler remarked, “Trade policy is evolving and may continue to shift, as it did this morning. Nonetheless, even if tariffs remain close to currently announced levels, they still appear likely to have significant economic effects.”

A prior Commerce Department announcement revealed that the U.S. and China agreed to temporarily reduce tariffs on each other’s goods to advance negotiations for a broader trade agreement. The U.S. lowered tariffs on Chinese imports from a combined 145% to 30%, while China cut tariffs on U.S. goods from 125% to 10%.

Even so, Kugler emphasized that U.S. average tariff levels remain far above historical norms. She added, “If tariffs stay significantly elevated compared to earlier this year, the economic effects may also remain elevated—including higher inflation and slower growth.”

Fed Policy Stance

The Federal Reserve held its benchmark interest rate steady for the third consecutive time last week. Kugler supported the decision, citing upside inflation risks and describing the Fed’s policy stance as “moderately restrictive.” She noted that the Fed is “well-positioned to respond to shifts in the macroeconomic outlook.”

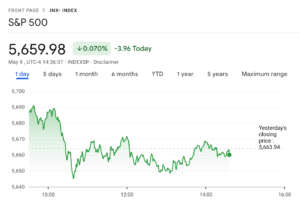

Following significant breakthroughs in U.S.-China trade talks, investors pared back bets on Fed rate cuts. Markets now expect no cuts before September and only a half-percentage-point reduction by year-end. Earlier, the CME FedWatch Tool had priced in a 25-basis-point cut at the upcoming June meeting and two additional cuts later in 2025.

Kugler stated, “Inflation and employment could move in different directions going forward, and I will closely monitor developments as I consider the appropriate policy path.”

Tariffs as a Negative Supply Shock

Kugler warned that tariffs could act as a “negative supply shock,” driving up prices while weakening economic growth and consumer demand. She noted that tariffs might also have a “significant impact” on productivity, as businesses could cut investments or adopt less efficient strategies to mitigate higher costs. Additionally, she cautioned that softer aggregate demand might make it harder for job seekers to find employment.

“This overall demand decline could exert downward pressure on inflation, but it may not be enough to offset the effects of adverse supply shocks,” Kugler explained.

Labor Market and Inflation Trends

Kugler described the U.S. labor market as “broadly stable” but highlighted that progress on reducing inflation has slowed since last summer. Surveys, including the Fed’s Beige Book, and other metrics indicate that tariffs have already influenced consumer and business behavior, sentiment, and expectations.

Kugler’s remarks underscore the dual risks of tariffs: exacerbating inflation through higher import costs while stifling growth via reduced demand and productivity. Despite tariff reductions, she stressed that elevated trade barriers by historical standards could prolong economic challenges, requiring vigilant monitoring by policymakers.

+ There are no comments

Add yours