Next week, U.S. stock investors will face a busy economic data calendar, focusing on whether market leaders are rotating away from defensive sectors—a potential signal of rising risk appetite.

Defensive Sectors Outperform Amid Uncertainty

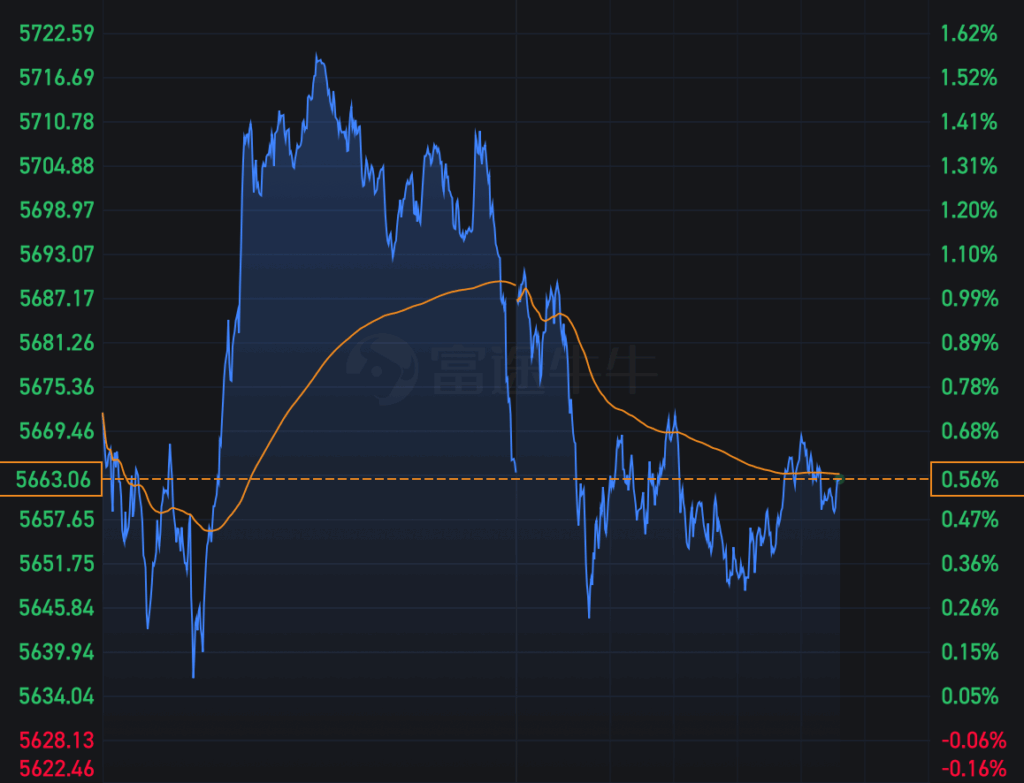

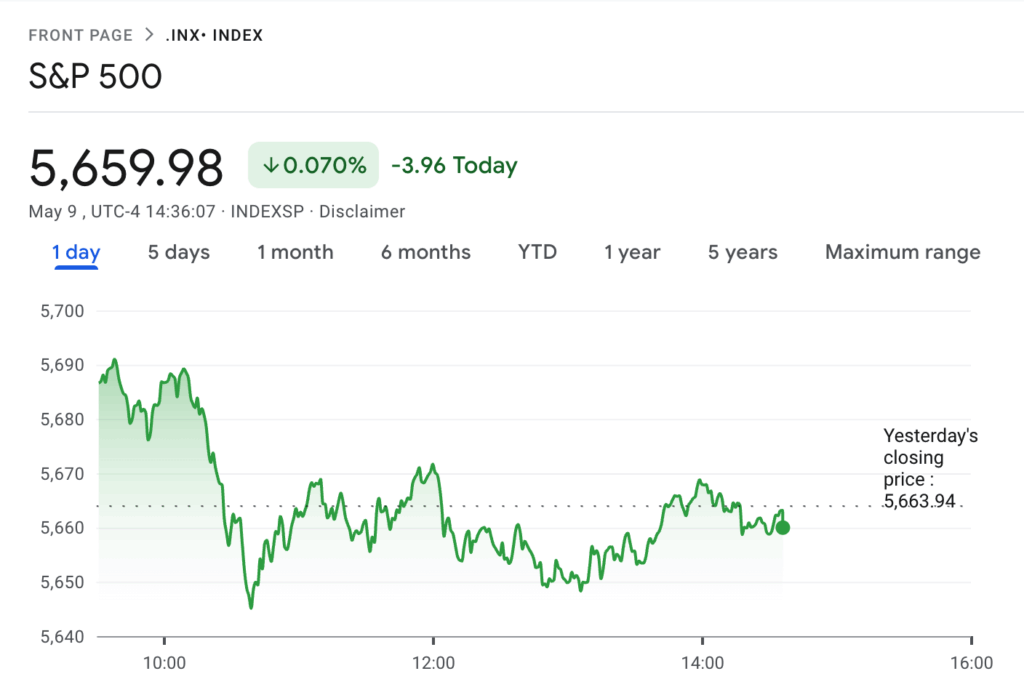

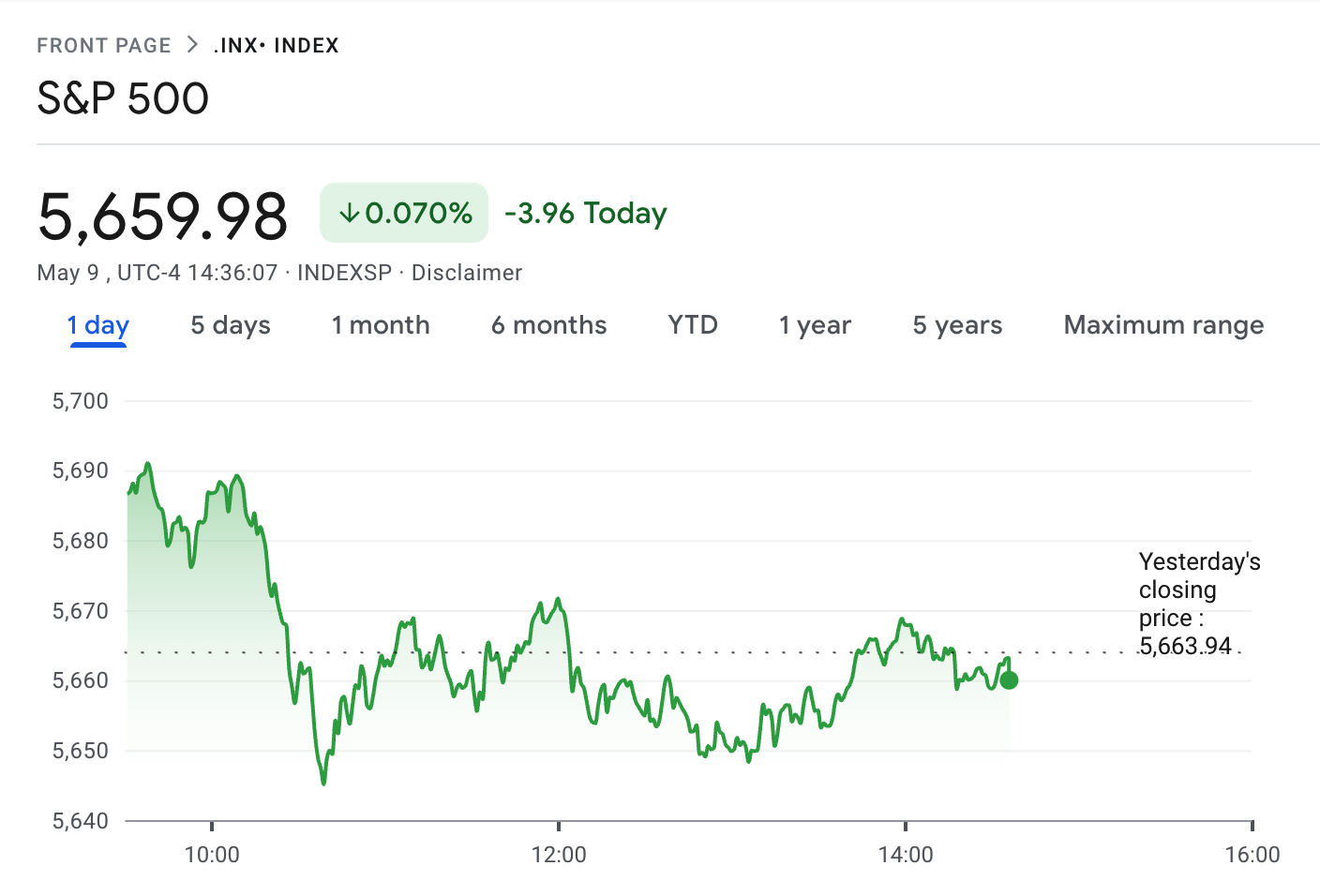

Despite the benchmark S&P 500 falling 3.7% in 2025 amid volatility driven by fears over economic damage from Trump-era tariffs, defensive sectors like consumer staples and utilities, traditionally seen as safe havens, have gained 5% and 5.6% year-to-date, respectively.

Investors typically flock to these sectors during risk-off periods due to their perceived resilience to economic slowdowns and reliable dividends. Chuck Carlson, CEO of Horizon Investment Services, noted: “If the market is in risk-aversion mode, these sectors will continue to lead.”

Signs of Rotation to Risk-On Sectors

Recently, however, sectors tied to economic optimism—such as tech, industrials, and consumer discretionary—have outperformed as markets rebounded from April lows. A shift in leadership to economically sensitive sectors like financials or energy “could signal investors regaining some ‘animal spirits’ about the economic outlook,” said Mark Luschini, Chief Investment Strategist at Janney Montgomery Scott. “It would suggest investors are becoming less cautious.”

Divergence Between Data and Sentiment

While hard data this year has shown economic resilience, sentiment surveys and other “soft data” remain weak. Matthew Miskin, Co-Chief Investment Strategist at Manulife John Hancock Investments, highlighted the dilemma: “Are we seeing just a sentiment-driven slowdown reflected in defensive stock tilts, or something more fundamental?”

Key Data Points to Watch

Next week’s economic releases will provide critical insights:

- April CPI (Tuesday, May 13): Latest read on inflation trends.

- April Retail Sales (Thursday, May 15): Snapshot of consumer spending.

Concerns linger that tariffs could drive prices higher and slow growth. Miskin warned that a hotter-than-expected CPI paired with weaker retail sales might spark fears of “stagflation”—stagnant growth coupled with persistent inflation—pressuring equities.

Fed Signals and Earnings in Focus

The Federal Reserve, in its latest meeting, hinted at balancing inflation and unemployment risks while holding rates steady. Beyond data, corporate earnings—including retail giant Walmart—will also sway markets.

Trade Negotiations Offer Hope

Stocks rallied Thursday after Trump and UK Prime Minister Starmer announced a trade deal, the first since Trump’s tariff hikes sparked global trade tensions. With a 90-day pause on harshest tariffs, investors are watching for further agreements. CFRA strategists noted: “Global negotiations are gaining momentum, with rising optimism that deals could emerge before the pause expires.”

+ There are no comments

Add yours