As Google’s I/O developer conference approaches, all eyes are on the tech giant, with investors eagerly awaiting proof of $Google-A (GOOGL.US)$/$Google-C (GOOG.US)$’s AI prowess, hoping for a stock price turnaround.

On Tuesday and Wednesday (May 20-21), Google will host its 2025 Google I/O conference at the Shoreline Amphitheatre in Mountain View, California. The event will showcase updates on software products and preview new features.

According to public disclosures, Google is expected to unveil significant updates on Android, Chrome, Google Search, YouTube, and its AI chatbot Gemini, with a major focus on a systematic showcase of Gemini 2.5 and its multi-platform strategy.

Alphabet investors are pinning hopes on the Google I/O conference, starting Tuesday, to highlight the company’s latest AI advancements and alleviate concerns about threats to its long-term market dominance. As Google heavily invests in AI, investors are increasingly worried that competitors are eroding its core search business.

Traders are holding their breath, hoping this could be a pivotal moment to reshape the market’s perception of Google’s AI narrative.

Analysts note that while Google is pouring resources into AI, concerns are growing that rivals are chipping away at its search business. Investors are eager for Google to prove its AI strength at this annual event, which could be a critical juncture for its stock price.

Trading data shows a surge in options activity around the conference, with markets anticipating potential stock price volatility. A compelling AI showcase could shift investor sentiment about Google’s position in the AI race, potentially driving stock gains. However, a lackluster presentation could deepen concerns about Google falling behind in AI competition.

David Katz, Chief Investment Officer at Matrix Asset Advisors, said:

“People want the conference to deliver a robust roadmap for the future because everyone’s waiting for the other shoe to drop and ready to pull the trigger on any negative news. I think Google is stronger than its current stock price suggests, so I see negative sentiment as a buying opportunity, but it does face more headwinds in AI than in traditional search.”

AI Competition Threatens Search; What Will Satisfy Investors?

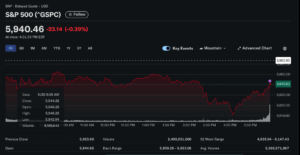

Alphabet’s stock has underperformed, dropping 12% year-to-date, while the Nasdaq 100 has risen 2% over the same period. Alphabet’s current price-to-earnings (P/E) ratio is 16.4, below its 10-year average of 20.5 and significantly lower than the Nasdaq 100’s P/E of 26.

Recent stock weakness partly stems from testimony by Apple executives stating that search volume on Safari declined in April for the first time. Alphabet disputed this, noting it will address market concerns with innovations shared at I/O.

The Information reported last week that Alphabet will introduce an AI agent for software development and Pinterest-like features at the conference, alongside updates to its Gemini AI chatbot. Analysts are particularly focused on potential AI product and service launches, expecting Google to showcase advancements in its next-generation large language model, Gemini, and how AI is integrated into its search engine, cloud services, and Android ecosystem.

Ben Reitzes, Head of Technology Research at Melius Research, said:

“Alphabet will definitely come out swinging at the event, but to be more bullish about the future, we need evidence that Gemini can be monetized to replace what we know as search. The company risks losing younger users to firms like OpenAI.”

Bernstein analyst Mark Shmulik noted:

“Given recent data like slowing paid click growth, Safari search volume declining for the first time in 22 years, and ChatGPT and Meta AI nearing 1 billion users, a good story alone may not be enough to impress investors this time.”

Michael Brenner, Senior Research Analyst and Asset Allocation Strategist at FBB Capital Partners, added:

“If Alphabet can integrate its stellar technology, talent, data, and user base into a compelling product at I/O, there’s clear upside potential. The stock looks cheap, but it’s not our largest overweight position because of these questions around its core business. If these threats persist, the P/E ratio could fall further.”

+ There are no comments

Add yours