📌 ETF Spotlight

- The article highlights the iShares Semiconductor ETF, a fund heavily weighted toward chipmakers such as Broadcom, Nvidia, and AMD.

- It suggests that if the ETF sustains its historic 20.9 % annual gains, the initial $250 000 investment could grow to $1.6 million over ten years—significantly exceeding the $1 million target.

🔍 Why These Semiconductor Stocks Matter

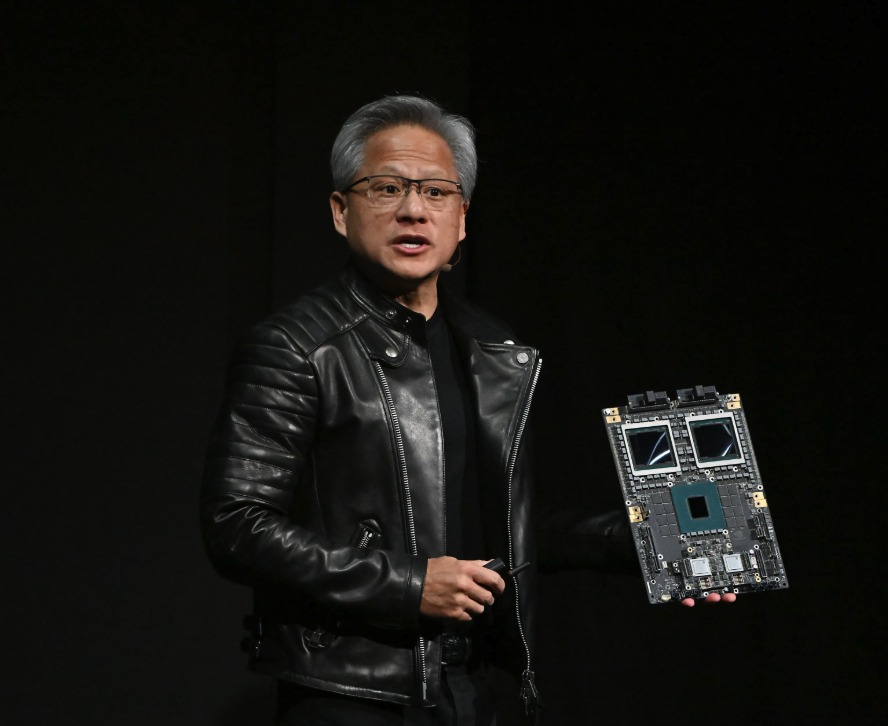

- The current chip boom is fueled by surging data center demand, particularly for AI-related hardware. Broadcom, Nvidia, and AMD dominate this space with high-margin, high-growth products.

- The ETF delivers exposure to these three giants, offering a diversified yet powerful portfolio aligned with secular tech trends.

💡 Historical Performance & Growth Potential

- Over the past decade, the iShares Semiconductor ETF has posted a ~1,170 % return, translating to a nearly 8-fold gain since launch.

- The current thesis projects continued gains at ~20–21% annually—an ambitious pace, but grounded in the accelerating AI and data infrastructure revolution.

⚠️ Key Considerations & Risks

| Factor | Description |

|---|---|

| Growth Assumptions | Sustaining 20%+ returns annually is aggressive—past performance does not guarantee future results. |

| Sector Volatility | Chip valuations tend to swing with demand cycles; economic slowdowns or capex pullbacks could disrupt momentum. |

| Competitive & Regulatory Risks | Global competition, supply-chain volatility, and geopolitical tensions (e.g., U.S.–China tech restrictions) may impact earnings. |

🧭 Is $1M Realistic?

- Bull Case: AI adoption keeps data center capex rising, and the ETF continues to ride the wave—resulting in potential 4x returns.

- Baseline Outlook: Even at 15% annual growth, a $250K investment could double to $1M in around 5 years—not 10—showcasing semiconductor power.

- Bear Case: A market correction or earnings slowdown could reset growth rates, delaying or derailing the $1M milestone.

🗓 Top Watchpoints

- Semiconductor companies’ quarterly guidance on data center and AI chip demand

- Updates on U.S.–China tech policy or semiconductor export controls

- Broader economic indicators affecting capital investment in technology

✅ Bottom Line

The iShares Semiconductor ETF’s historic returns are compelling, buoyed by chip leaders like Broadcom, Nvidia, and AMD. At a projected 20.9% compound annual growth rate, the fund could surpass $1M from a $250K start in less than a decade, even approaching $ 1.6 M. Yet the pace is lofty, and the sector is prone to cycles and volatility. This investment is high-potential, but high-risk.

+ There are no comments

Add yours