📍 Lead

Shares of Nvidia climbed ~2% to approximately $144.51 after CEO Jensen Huang unveiled strategic investments in the U.K. and addressed global trade dynamics at London Tech Week. Markets also impacted by optimism around U.S.–China trade talks in the city.

🎯 Key Developments

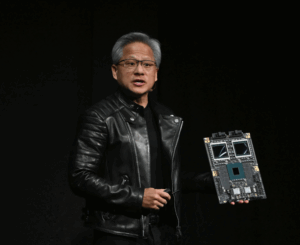

- U.K. AI Push: Huang launched the U.K. sovereign AI forum with Prime Minister Keir Starmer and pledged to back the U.K.’s AI infrastructure ambitions, including deploying tens of thousands of Nvidia Blackwell GPUs through partners Nscale and Nebius. He called the U.K. a “Goldilocks” AI ecosystem—rich in talent but lacking infrastructure.

- Trade Talks: Concurrent U.S.–China trade discussions are underway in London. Progress in reducing tariffs could serve as a tailwind for Nvidia and other chipmakers. A rebound in investor confidence may depend more on these talks than on U.K. developments. barrons.com

- UK‑specific Concerns: Huang emphasized the need to increase U.K. computing capacity 20-fold. Prime Minister Starmer responded with a £1 billion commitment to boost AI compute power, supported by Nvidia’s new AI Centre in Bristol and a partnership with the Financial Conduct Authority.

📈 Stock Impact & Context

- Nvidia’s rally (up ~45% since April) is fueled by easing export regulations, Q1 results, and deal-making—such as the Saudi chip sale deal. businessinsider.com

- However, longer-term concerns linger: export constraints to China, intensifying competition, and geopolitical uncertainty remain headwinds. barrons.com

🧭 Implications for the Stock

✅ Positives

- Entry into the U.K. infrastructure ecosystem further cements Nvidia’s global dominance in AI hardware.

- Ongoing trade negotiations: positive outcomes may unlock renewed growth, reducing uncertainty.

⚠️ Risks

- Policy missteps or infrastructure delays in the U.K. could damp enthusiasm.

- Escalating U.S.–China tensions remain a persistent wildcard, with potential to disrupt growth.

🗓 What to Monitor

- Outcomes of U.S.–China trade talks—crucial for resolving tariff-related disruptions and restoring export confidence.

- U.K. infrastructure roll-outs—progress deploying Nvidia GPUs through Nscale, Nebius, and the AI Centre will signal execution strength.

- Further commentary from Huang or market analysts at upcoming global tech forums (e.g., GTC Paris, Financial Times coverage).

✅ Bottom Line

Nvidia’s stock is buoyed by Huang’s bullish tone on the U.K.’s AI future and the promise of diplomatic clarity in trade. These signals support the rally—but execution and geopolitical shifts remain decisive. Investors should watch both global trade narratives and the real-world delivery of U.K. compute infrastructure to gauge whether the optimism translates into long-term value.

+ There are no comments

Add yours